free crypto tax calculator australia

Now that you are clear on how to use our crypto tax calculator and what taxes you will pay on crypto consider how. The Enterprise plan will cost you 249 and cover 60M AUM.

Free Crypto Tax Calculator 2022 Online Tool Haru

Koinly is a cryptocurrency tax software for hobbyists investors and accountants.

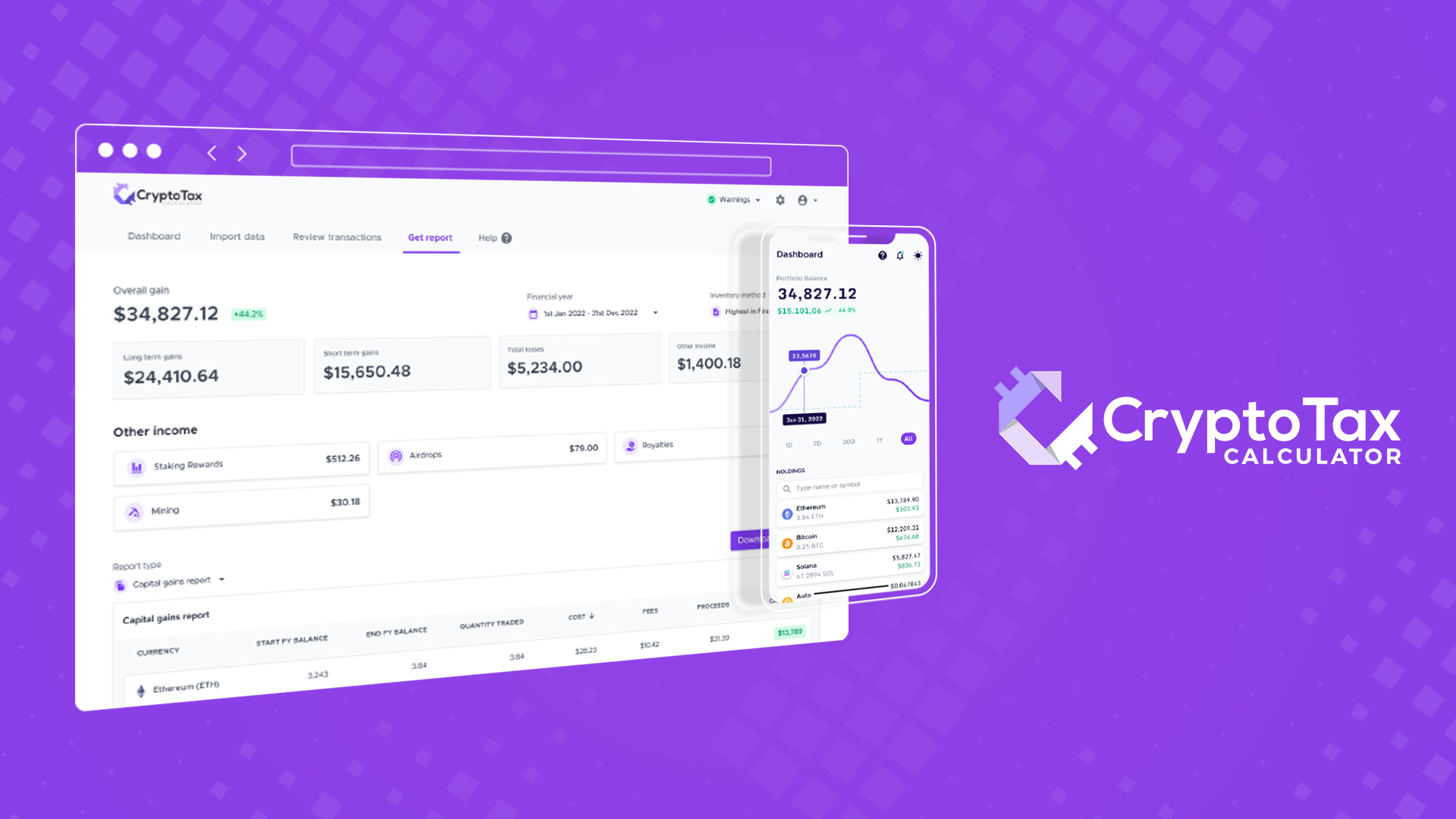

. This service enables users to quickly generate accurate and organised tax reports including transaction history and records of shortlong-term capital gains and losses as well as other crypto-related taxable and non-taxable transactions. Divide the initial investment amount with the amount of crypto purchased lets assume 1000 coins. Covers NFTs DeFi DEX trading.

Automated Crypto Trading With Haru. Crypto Tax Calculator for Australia. Will provide more constructive feedback as soon as I.

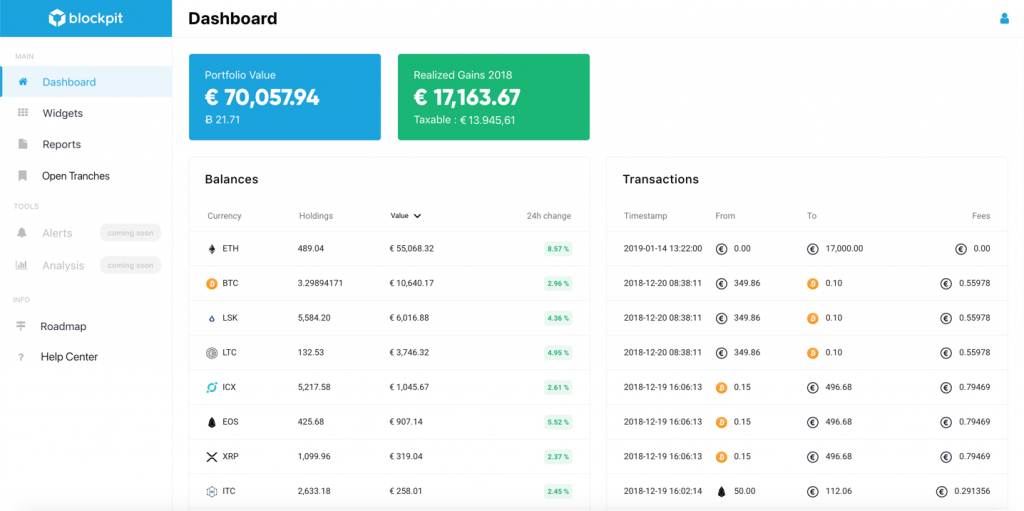

Simply import your cryptocurrency data in form of a CSV file and calculate the capital gain taxes in Australia instantly. Youre viewed as a crypto trader by the ATO as its your main source of annual income. Partnered with Aussie International Exchanges.

Our Australian crypto tax calculator is the perfect tool whether you are a beginner trader or an experienced crypto king. BearTax - Calculate File Crypto Taxes in Minutes. ATO Tax Reports in Under 10 mins.

Koinly was built to solve this very problem - by integrating with all major blockchains and exchanges such as Coinbase Binance Kraken etc Koinly. Our Australian crypto tax calculator is the perfect tool for anyone to calculate their crypto tax. ATO Tax Reports in Under 10 mins.

Easy to understand and navigate through the pages and data flexible to monitor and correct any transaction discrepancy above all responsive team to all my inquiries. Or Sign In with Email. Disposing of cryptocurrency purchased with fiat currency a currency established by a countrys government regulation or law Tim purchased 400 USD Tether USDT for A800.

Calculate and report your crypto tax for free now. To calculate tax on crypto-to-crypto transactions you have to calculate the value of each crypto in fiat. Accurate and complex calculations.

Australian Dollars triggers capital gains tax. Our Australian crypto tax calculator is the perfect tool whether you are a beginner trader or an experienced crypto king. Take the initial investment amount lets assume it is 1000.

Tailored as per the ATO guidelines the algorithm provides an accurate report of your crypto gainslosses for a financial year. Supports ATO Tax Guidelines. 1 BTC is now worth A12000.

There are cloud-hosting tools specifically designed for crypto miners. Crypto tax platforms can help in ways to calculate your capital gains track Bitcoin prices at specific datestimes for personal income tax returns and company transaction reporting. Your first 18200 of income is tax free.

Australias first crypto accounting and tax tool which has been vetted by a Chartered Accountant. Save 70 on accounting fees by providing them auto-generated document. Blox free Pro plan costs 50K AUM and covers 100 transactions.

Were still picking up a lot of customers who were trading in 20172018. Users can import crypto transaction records from supported exchanges and wallets by uploading a CSV file. Get help with your crypto tax reports.

After recognizing your crypto airdrop as ordinary income the FMV becomes your cost base for future trading operations. Australian Tax Office Targets Cryptocurrency Investors. Discover how much taxes you may owe in 2021.

If you later sell some or all of your crypto airdrops for a profit youll have to pay capital gains tax on the difference between the ordinary income value and the sale proceeds. Anyone who owns multiple exchange accounts or wallets knows the pains when it comes to declaring taxes. Calculate and report your crypto tax for free now.

Crypto Tax Calculator Australia Use the free crypto tax calculator below to estimate how much CGT you may need to pay on your crypto asset sale. In Australia youll pay Capital Gains Tax and Income Tax on your crypto investment. The business plan comes at 99 per month and covers 10K taxations and 20 million in assets.

It has full integration with popular Australian exchanges wallets to import your crypto. The resulting number is your cost basis 10000 1000 10. Use our Crypto Tax Calculator.

Koinly is the only cryptocurrency tax calculator that is fully compliant with ATOs crypto tax guidance. Get started today and maximize your refund. As weve seen in our Cryptocurrency Tax Guide in Australia any crypto-to.

Import your cryptocurrency data and calculate your capital gain taxes in Australia instantly. If he were to sell his BTC and cash out he would have to pay taxes on A7000 A12000 A5000 of capital gains. Sign In with Google.

Selling cryptocurrency for fiat currency eg. For example lets say Sam bought 1 bitcoin BTC for A5000 five years ago. If you hold for a year youll pay 50 less capital gains tax on crypto gains.

Full integration with popular exchanges and wallets in Canada with more jurisdictions to come. The percentage of Capital Gains Tax youll pay is the same as your personal Income Tax rate starting only from earnings above 18201. The brothers founded the.

Heres an example of how to calculate the cost basis of your cryptocurrency. Only capital gains you make from disposing of personal use assets acquired for less than 10000 are disregarded for capital gains tax purposes. You made 50000 throughout the 2021 - 2022 financial year.

Your tax authority wants to know your equivalent profits or losses in the local fiat USD GBP AUD or CAD. This is why cryptocurrency tax Shane explains is kind of a lagging market. Straightforward UI which you get your crypto taxes done in seconds at no cost.

Youll then pay 19 tax on the next 26799 of income and finally 325 tax on the final 5000 of income - or roughly 6717 in total.

How To Calculate Crypto Taxes Koinly

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Crypto Staking Rewards Calculator Accointing Crypto Blog Knowledge Crypto Taxes Guides Tips

Koinly Crypto Tax Calculator For Australia Nz

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

Crypto Tax Prep We Help You Save On Taxes Kpoinly Koinly

Bitcoin Price Prediction Today Usd Authentic For 2025

![]()

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

![]()

Cointracking Crypto Tax Calculator

Crypto Tax In Australia The Definitive 2021 2022 Guide

Best Crypto Tax Software 10 Best Solutions For 2022

30 Off Crypto Tax Calculator 1 Year Subscription Rookie 29 40 Hobbyist 76 20 Investor 149 40 Trader Compare Cards Credit Card Benefits Student Rewards

Australia S Cryptotaxcalculator Helps Traders Demystify The Decentralized Techcrunch

Realtymonks One Stop Real Estate Blog Debt Relief Programs Tax Rules Debt Relief

Australia Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

![]()

Cointracking Crypto Tax Calculator

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda